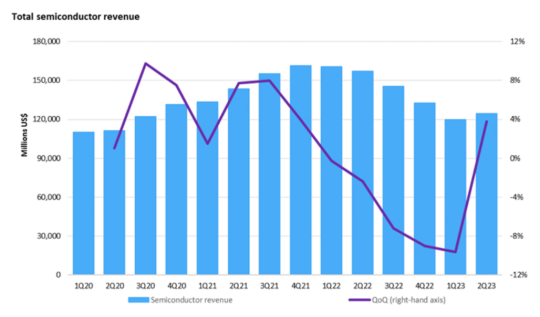

Omdia, a reputable research institution, has recently unveiled its Semiconductor Industry Competitive Landscape Tracking Report, presenting valuable insights for stakeholders in the electronic components sector. This report signifies a noteworthy upturn in the semiconductor industry during the second quarter of 2023, marking a pivotal moment after enduring five consecutive quarters of revenue decline.

The study reveals that second-quarter revenues experienced a robust quarter-over-quarter growth rate of 3.8%, surging to a total of $124.3 billion. This growth trend aligns with historical patterns observed in the semiconductor market, where the second quarter typically witnesses an average revenue increase of 3.4% compared to the first quarter, as evidenced by data spanning from 2002 to 2022. However, it is worth noting that the semiconductor industry's growth trajectory continues to diverge from these established historical norms. A notable example is the DRAM market, which recorded an exceptional 15% growth in the second quarter of 2023, surpassing the historical average of 7.5% for this quarter.

This resurgence is a welcome development for the semiconductor industry, as it rebounds from its most extended period of contraction since Omdia commenced its market tracking activities in 2002. However, it is important to acknowledge that the impact of the previous market contraction still lingers, with current semiconductor revenues standing at a modest 79% of their levels from the same period one year ago. To regain the revenue levels observed at the close of 2021, the industry will require a sustained recovery effort over time.

The report prominently highlights the role of NVIDIA in stabilizing the semiconductor industry throughout the second quarter. The entire industry witnessed a $4.6 billion increase in revenue compared to the preceding quarter, with NVIDIA's contributions amounting to a substantial $2.5 billion of this growth. NVIDIA's ascendancy in the generative AI market, driven by the rapid surge in demand for AI chips within server applications, continues to propel the company's ascent in market share rankings.

The report further underscores the expansion of the data processing sector, driven by the integration of artificial intelligence chips into the server domain. This segment exhibited a remarkable quarter-over-quarter growth rate of 15%, constituting nearly one-third (31%) of total semiconductor revenue in the second quarter of 2023. Conversely, the wireless segment market, primarily rooted in smartphone technology, emerged as the second-largest segment but experienced a marginal 3% quarter-over-quarter decline due to persistently tepid consumer electronics demand. Meanwhile, the automotive semiconductor industry maintained its upward trajectory with a commendable 3.2% growth rate.