On November 10th, Mercury Research, a reputable market research firm, released its latest findings, showcasing AMD's remarkable revenue and market share advancements across servers, laptops, and desktop computers in the third quarter of 2023.

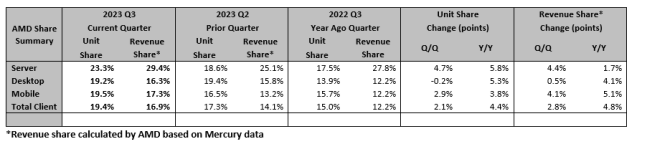

In an impressive feat, AMD elevated its overall CPU market share from 17.3% in the previous quarter and 15% a year ago to a notable 19.4%. This substantial growth extends to revenue shares as well, indicating AMD's successful penetration into the market for higher-value components throughout 2023.

Breaking down the figures by market segment, AMD experienced notable increases in shipment shares in the desktop (5.3 percentage points), mobile (3.8 percentage points), and server (5.8 percentage points) sectors during Q3 2022 compared to the same period in 2022. This resulted in market shares of 19.2%, 19.5%, and 23.3%, respectively. In terms of revenue share growth, AMD outperformed competitors with a 4.1 percentage point increase in desktop revenue share (16.3%), a 5.1 percentage point increase in mobile PC revenue share (17.3%), and a 1.7 percentage point increase in server revenue share (29.4%).

Despite market challenges in previous quarters due to efforts to normalize inventory levels and adjust supply and demand, AMD demonstrated resilience. Back-to-school and holiday processor purchases by personal computer manufacturers, coupled with increased production of machines based on AMD's EPYC and Intel's Xeon platforms by server manufacturers, contributed to a normalization of the market in Q3 2023. Mercury Research data confirms that, overall, AMD's performance outpaced that of Intel during this period, with significant market share growth.

According to Mercury Research's Q3 2023 data, AMD's market share in the client and server CPU markets exhibited year-over-year growth. Although specific figures for Intel and Arm are not provided, considering AMD and Intel's dominance in laptops, desktops, and servers, it is inferred that AMD's growth corresponds to a decline in Intel's market share.

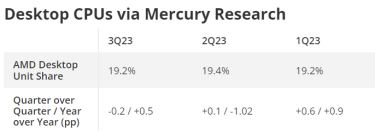

In the desktop computer segment, AMD's Q3 2023 shipment share was 19.2%, slightly lower than the previous quarter but significantly higher than the same period last year. Notably, revenue share in this segment increased both sequentially and year-over-year, reflecting a rise in average selling price attributed to the adoption of higher-value AMD Ryzen 7000 components.

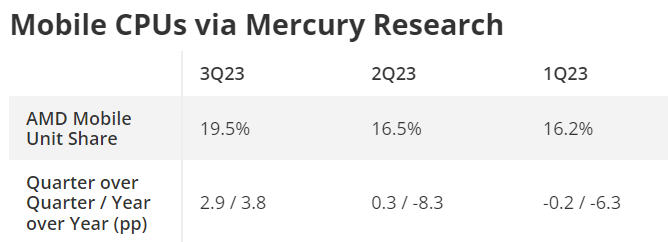

For mobile PC processors, AMD achieved a Q3 2023 shipment share of 19.5%, surpassing the previous quarter and the same period in 2022. While this is lower than the peak of 24.8% in Q2 2022, updated data suggests that one-fifth of upcoming laptop sales will feature AMD processors. Additionally, AMD's revenue share in the mobile PC processor market demonstrated accelerated growth, signaling higher average selling prices and increased competitiveness with the Ryzen 7000 series products.

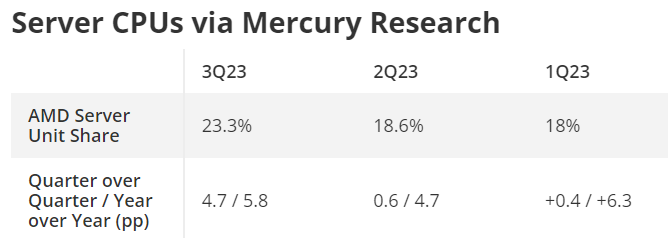

Since 2017, AMD has steadily increased its server CPU market share, with breakthroughs in 2022 and 2023 marked by rapid growth over the past few quarters. In Q3 2023, AMD's server segment shipment share rose to 23.3%, reflecting a substantial increase from the previous quarter and the same period last year. Revenue share also experienced significant growth, further bolstered by the popularity of AMD's fourth-generation EPYC processors, making them the preferred choice for major cloud providers in both internal workloads and public instances.