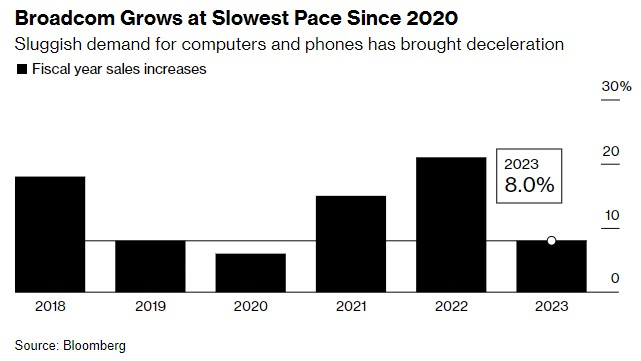

On December 8th, Broadcom, following the successful $66 billion acquisition of VMware, released its fourth-quarter financial report post-market closure. The reported revenue for the quarter ending on October 29th showed a 4.1% year-over-year increase, marking the smallest single-quarter growth rate since 2020. Broadcom forecasts its 2024 revenue to be approximately $50 billion, inclusive of VMware's revenue, indicating a figure seemingly lower than the initial combined revenue expectations of the two entities.

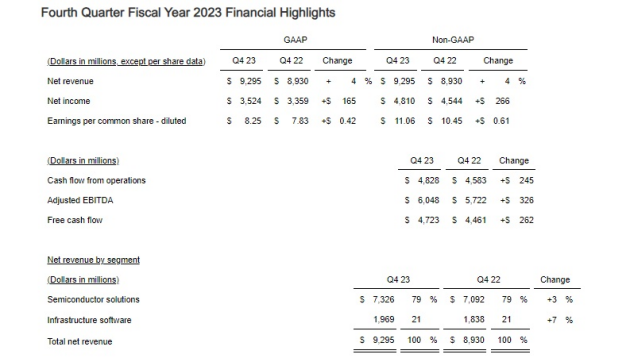

Breaking down the specifics, Broadcom's Q4 2023 revenue reached $9.3 billion, surpassing market expectations with a 4.1% year-over-year increase. Net profit amounted to $3.524 billion, reflecting a 5% year-over-year increase, with diluted earnings per share at $8.25, compared to $7.83 in the corresponding period the previous year. Excluding certain items, Broadcom's Q4 earnings per share stood at $11.06, exceeding analysts' predictions of $10.93.

In terms of business segments, Broadcom's semiconductor solutions yielded $7.33 billion in Q4 revenue, surpassing the expected $7.27 billion and experiencing a 3% year-over-year growth. The infrastructure software business witnessed a 7% year-over-year growth, achieving $1.97 billion in revenue.

For the entire fiscal year of 2023, Broadcom reported a revenue of $35.82 billion, an 8% year-over-year increase, marking the slowest growth rate since 2020. Net profit amounted to $14.082 billion, reflecting a 22.6% year-over-year increase, with diluted earnings per share at $32.98, compared to $26.53 in the prior year.

Broadcom acknowledged that the deceleration in the growth rate of its revenue is attributed to sluggish demand in the computer and smartphone sectors. Despite supplying chips to various technology giants across multiple sectors, the modest revenue growth indicates a subdued industry landscape.

Looking ahead to the next fiscal year, Broadcom anticipates mid to high single-digit percentage growth in its semiconductor business, particularly in the data center and artificial intelligence technology markets. However, this projected performance is relatively slower compared to the growth rates observed in the past two years.

Broadcom currently plays a pivotal role in providing essential components for Apple's iPhone, crafting customized chips for Google's parent company, Alphabet, and holding the position of the largest supplier of network components facilitating data center and computer connectivity. This strategic positioning positions Broadcom to benefit significantly from the evolving landscape of the artificial intelligence computing market.

Broadcom further forecasts its 2024 revenue, inclusive of VMware, to reach around $50 billion, with an expected 40% year-over-year growth. However, this projection appears to fall short of the combined sales expectations initially envisioned by the two entities. Additionally, according to disclosed documents, Broadcom is actively engaged in the integration of VMware, with an estimated expenditure of $1.3 billion by the fiscal year 2025.

Subsequent to the release of the financial report, Broadcom's stock experienced a 2.4% decline in after-hours trading. Nonetheless, driven by optimism surrounding the chip industry's resurgence, Broadcom's stock exhibited a notable 65% increase throughout the year 2023.