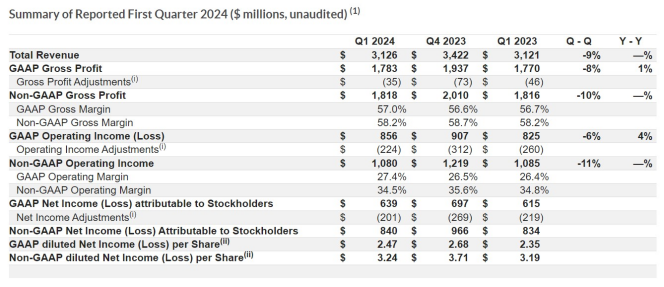

On April 29, NXP Semiconductors, a leading provider of automotive chips, announced its Q1 2024 financial results for the period ending March 31, 2024. Revenue stood at $3.126 billion, showing a 0.2% increase year-over-year and a 9% decrease quarter-over-quarter. The non-GAAP operating income was $1.08 billion, marking a 0.5% decrease year-over-year and an 11% decrease quarter-over-quarter. The non-GAAP gross margin remained steady at 58.2%, while the non-GAAP operating margin fell to 34.5% from 34.8% in Q1 2023 and 35.6% in Q4 2023. The non-GAAP earnings per share (EPS) experienced a 1.6% increase year-over-year to $3.24, but a 12.7% decrease quarter-over-quarter.

In terms of business performance, NXP's Q1 2024 revenue from automotive chips dropped 1% year-over-year and 5% quarter-over-quarter to $1.804 billion. Revenue from industrial and IoT chips increased 14% year-over-year and decreased 13% quarter-over-quarter to $574 million. Mobile chip revenue rose 34% year-over-year and fell 14% quarter-over-quarter to $349 million. Communication infrastructure and other products' revenue declined 25% year-over-year and 12% quarter-over-quarter to $399 million.

NXP CEO Kurt Sievers highlighted that revenue trends across all key end markets aligned with expectations. For Q2 2024, NXP projects revenue in the range of $3.025 billion to $3.225 billion, with a midpoint of $3.125 billion, representing a 5% decline year-over-year. This estimate is slightly below analysts' expectations of $3.13 billion. The anticipated non-GAAP gross margin is between 58.0% and 59.0%, with a midpoint of 58.5%. Operating margin is expected to range from 33.1% to 35.0%, with a midpoint of 34.0%. Non-GAAP EPS is projected to be between $3.00 and $3.41, with a midpoint of $3.20, which is slightly higher than analysts' expectations of $3.11.