According to a report by WSTS, the global semiconductor market experienced a significant increase of $16.6 billion in Q3 2024, marking a 10.7% growth compared to Q2 2024. This is the highest quarter-on-quarter growth since Q3 2016, which saw a 11.6% increase. Year-on-year, the semiconductor market grew by 23.2% in Q3 2024, the highest since Q4 2021, when growth reached 28.3%.

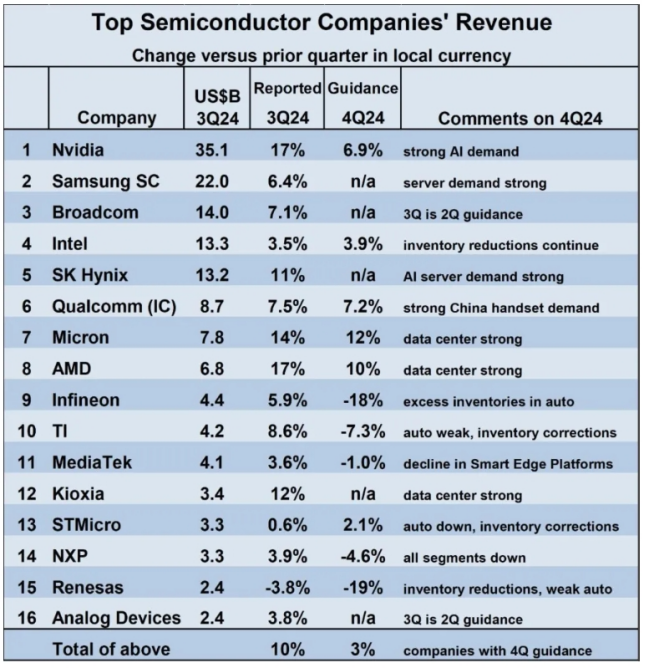

In terms of leading companies, NVIDIA continues to dominate the semiconductor industry, driven by its strength in AI GPUs, with Q3 2024 revenue reaching $35.1 billion. Samsung Semiconductor ranks second with $22 billion in revenue, fueled by growth in AI server memory. Broadcom secured the third position with an estimated $14 billion in revenue for Q3 2024, with AI semiconductors acting as a key growth driver. Intel and SK hynix round out the top five companies.

Regarding downstream applications, forecasts for 2024 show a mixed outlook, with some positive and negative trends. According to IDC, artificial intelligence is expected to drive a strong 42% increase in server revenue in 2024, with a continued growth of 11% into 2025. Both smartphones and personal computers are recovering from the declines seen in 2023, with growth projected for 2024. However, IDC forecasts a modest low single-digit growth rate for smartphones and PCs in 2025. Additionally, the S&P Global Mobility Index indicates a 10% increase in light vehicle production in 2023 due to post-pandemic recovery, but a slight 2.1% decline is expected in 2024, with a small rebound of 1.8% growth projected for 2025.

Looking ahead to global semiconductor market projections for 2024 and 2025, Future Horizons forecasts a 15% growth in 2024, aligning with estimates from Semiconductor Intelligence (SC-IQ). However, predictions for 2025 show slightly slower growth, with RCD Strategic Advisors and Gartner estimating a 16% and 13.8% increase, respectively. Semiconductor Intelligence anticipates a significant slowdown, forecasting only 6% growth in 2025. Future Horizons also expects growth to decelerate to 8% in 2025. Overall, institutions are more optimistic about the global semiconductor market in 2024 than in 2025.