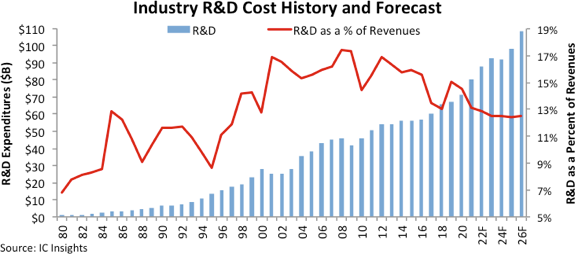

Chip companies will boost R&D spending by 9% to $80.5 billion in 2022, following record investment in 2021, according to market research firm IC Insights. Spending in 2021 hit a record $71.4 billion, up 13% from the previous year.

Semiconductor companies are also spending billions to buy fabs. Intel alone plans to invest $100 billion in the US and $100 billion in Europe. Both regions are incentivizing manufacturing and development of semiconductor supply chains as unprecedented chip shortages persist.

When the world was hit by Covid-19 in 2020, cautious semiconductor suppliers have been limiting spending on research and development, the research firm said, despite an 11 percent increase in the market that year. Semiconductor R&D spending as a percentage of global industry sales slipped to 13.1% in 2021 from 14.5% in 2020 and 15.1% in 2019, when R&D spending fell 1% and total chip market revenue fell 12%.

Total R&D spending by semiconductor companies is expected to grow at a compound annual growth rate (CAGR) of 5.5% between 2022 and 2026 to $108.6 billion.

IC Insights notes that total semiconductor R&D spending has declined in only four years since the 1980s:

(1) -1% during the economic slowdown in 2019;

(2)-10% The industry was hit by a major global recession in 2009 due to the collapse of financial markets;

(3)2001 and 2002 consecutive -10% declines and 2002, when the recession coincided with the end of the dotcom bubble.

After the global recession of 2008-2009, semiconductor R&D spending recovered strongly within a few years, but for the rest of the past decade, spending dropped for a variety of reasons, including continued economic uncertainty and a historic wave of acquisitions. slow.

IC Insights reports that total semiconductor R&D spending as a percentage of global sales has exceeded 14.5 in all but five years since 2000 (2000, 2010, 2017, 2018 and 2020). % of the four-year historical average. Over the five-year period, the lower R&D-to-sales ratio has more to do with the strength of total revenue growth than the weakness in semiconductor supplier R&D spending.

Intel leads all other chipmakers in R&D spending in 2021, accounting for about 19% of the industry total. Intel increased R&D spending 12% in 2021 to an all-time high of $15.2 billion as it tries to re-lead the rollout of next-generation IC processing technology and position itself as a leading provider of advanced foundry services part. In 2020, Intel's R&D spending increased only 1% after falling 1% in 2019.

Samsung is No. 2 in IC Insights' 2021 R&D ranking, with spending rising 13% to an estimated $6.5 billion after a 23% increase in 2020. The South Korean memory giant has accelerated R&D spending on cutting-edge logic processes (5nm and below) to increase competition with foundry market leader TSMC, which has increased its R&D spending in 2020 after growing 26% in 2020. It increased by 20% to about $4.5 billion in 2021.

IC Insights' 2021 R&D ranking shows that 21 semiconductor suppliers spend $1 billion or more on R&D, compared with 19 companies in 2020. Total spending on R&D for the top 10 increased 18 percent to $52.6 billion, or about 65 percent of the industry's total R&D last year. The R&D/sales ratio for the top 10 is 13.5% in 2021, compared to 14.5% in 2020.