On July 24, European semiconductor giant STMicroelectronics revealed its Q2 financial results, showing an operating loss of $133 million due to asset impairments and restructuring expenses. This marks the company's first quarterly loss since 2013 and triggered a sharp 15.86% drop in its stock price — the biggest decline in nearly a year.

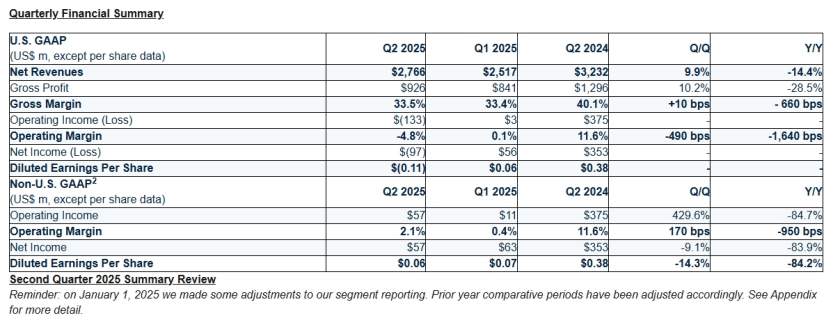

The report showed that STMicroelectronics'revenue for the second quarter of 2025 (ending June 28) fell 14.4% year-over-year to $2.76 billion, which still exceeded the company's own forecast and analyst estimates. To tackle the sales slump, the company launched a restructuring plan in April, incurring $190 million in related costs and impairments. Excluding these charges, the adjusted operating profit for the quarter was $57 million, meeting analyst expectations.

Looking ahead, STMicroelectronics expects Q3 revenue to reach $3.17 billion — a 2.5% decline compared to last year but above the average analyst forecast of $3.1 billion — as customer demand begins to recover.

Automotive chips remain a key revenue driver, with major clients like Tesla accounting for about 6% of total sales. However, the sector has faced headwinds recently due to reduced government subsidies for electric vehicles worldwide and tariffs imposed during the Trump administration that disrupted the U.S. auto market. These factors have led to a slowdown in automotive demand, impacting STMicroelectronics'operations.