On January 25, SK Hynix, the prominent South Korean memory chip manufacturer, unveiled its financial report for the fourth quarter of 2023 and the full year concluding on December 31, 2023.

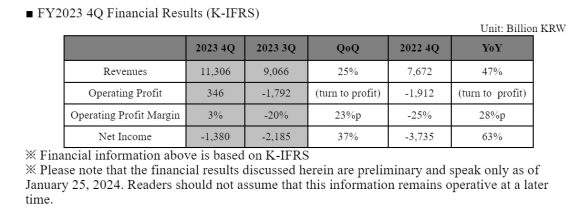

During the fourth quarter, the company experienced a remarkable 47% year-on-year revenue growth, reaching KRW 11.3055 trillion, exceeding analysts' expectations of KRW 10.4 trillion. The gross profit surged to KRW 2.23 trillion, marking an impressive 9404% year-on-year increase, with a gross profit margin of 20%, showcasing sustained improvement for three consecutive quarters. Operating profit stood at KRW 3.46 trillion (approximately RMB 18.54 billion), surpassing analysts' anticipated loss of KRW 1.6991 trillion, with an operating profit margin of 3%. However, the net loss was KRW 1.3795 trillion (approximately RMB 73.94 billion), a substantial reduction from the previous quarter, with a net loss rate of 12%. EBITDA witnessed a notable 99% increase, reaching KRW 3.58 trillion.

SK Hynix emphasized that the rebound in demand for memory chips played a pivotal role in achieving a profitable fourth quarter in 2023, with an operating profit of KRW 3.46 trillion. This turnaround marks a significant achievement within just one year, considering the continuous operating losses since the fourth quarter of 2022.

Highlighting the growth in demand for AI servers and mobile products in the fourth quarter of 2023, SK Hynix attributed the positive shift in the storage market environment to the increase in Average Selling Price (ASP). The company credited its profit-focused business plan for these favorable outcomes.

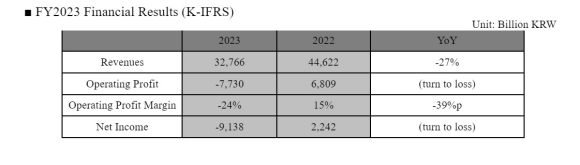

For the full year 2023, SK Hynix reported consolidated revenue of KRW 32.7657 trillion, operating losses of KRW 7.7303 trillion, and net losses of KRW 9.1375 trillion. The operating loss rate for 2023 was 24%, and the net loss rate was 28%.

In terms of its performance in the DRAM sector, SK Hynix highlighted its proactive response to customer demands with leading technological capabilities. The company reported significant revenue growth in its main products, DDR5 DRAM and HBM3, with more than a fourfold and fivefold increase, respectively, compared to 2022. In the NAND Flash memory market, where demand recovery was relatively slow, the business plan focused on efficiency in investment and costs.

Looking ahead to 2024, SK Hynix anticipates an increase in capital expenditure compared to the previous year, with efforts to minimize the growth rate. The company projects the first-quarter growth rates for DRAM BIT, NAND BIG, and NAND BIT to be within the ranges of 10%-20%, 0%-10%, and 0%-10%, respectively. SK Hynix emphasized that its operating strategy for 2024 will mirror that of 2023, prioritizing high-value-added products, expanding production, maintaining profitability and efficiency, while minimizing capital expenditures and focusing on stable business operations.