NVIDIA Corporation announced its financial results for the fourth quarter and fiscal year of the 2024 fiscal year ending on January 28, 2024. In the fourth quarter, NVIDIA reported a revenue of $22.1 billion, marking a 22% sequential growth and a substantial 265% year-over-year increase. The total revenue for the fiscal year 2024 reached $60.9 billion, showcasing a remarkable 126% year-over-year surge, setting historic records for both quarterly and annual revenues.

Jensen Huang, CEO of NVIDIA, highlighted the critical point reached in accelerating computing and generative artificial intelligence. The increasing demand for diverse data processing, training, and inference across global companies, industries, and nations has been a driving force behind the growth of NVIDIA's data center platform. Major cloud service providers, GPU specialists, enterprise software, and consumer internet companies are contributing to the momentum. Additionally, vertical industries such as automotive, financial services, and healthcare have now scaled to billions of dollars.

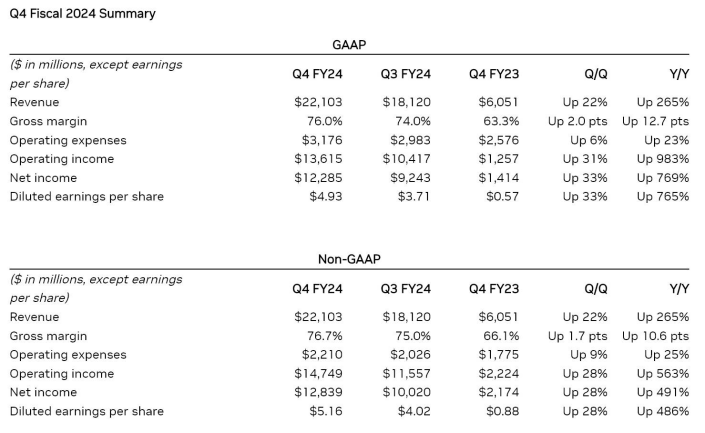

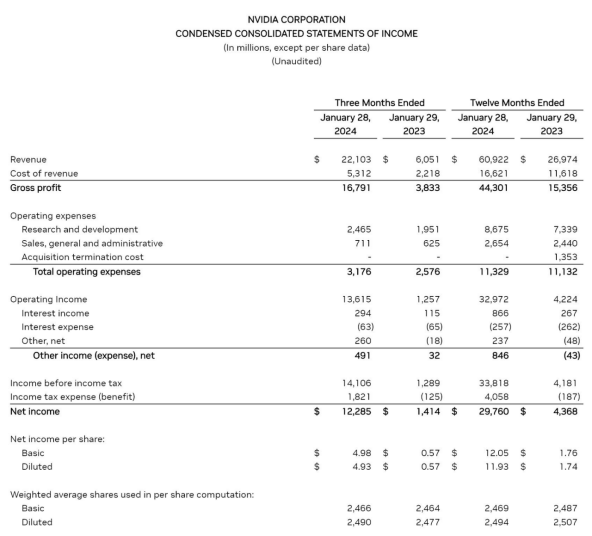

For the fourth quarter of the fiscal year 2024 (November 2023 to January 2024), NVIDIA reported a gross margin of 76.0%, operating expenses of $3.176 billion, operating income of $13.615 billion, and a net income of $12.285 billion. The GAAP diluted earnings per share were $4.93, reflecting a 33% sequential increase and an impressive 765% year-over-year growth. The non-GAAP diluted earnings per share were $5.16, showing a 28% sequential increase and a substantial 486% year-over-year growth.

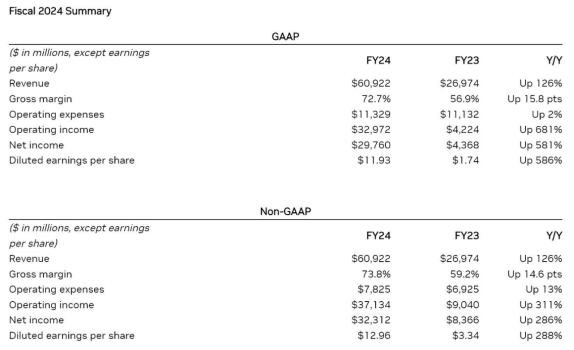

For the full fiscal year 2024 (February 2023 to January 2024), NVIDIA's total revenue amounted to $609.22 billion, with a gross margin of 72.7%, operating income of $32.972 billion, and a net income of $29.76 billion, demonstrating remarkable year-over-year increases of 681% and 581%, respectively. The GAAP diluted earnings per share were $11.93, marking a 586% year-over-year growth, while the non-GAAP diluted earnings per share were $12.96, reflecting a 288% year-over-year increase.

In the data center business segment, including AI chips, NVIDIA achieved a record revenue of $18.4 billion in the fourth quarter, with a 27% sequential increase and an outstanding 409% year-over-year growth. The annual revenue saw a remarkable 217% increase, reaching a record $47.5 billion. NVIDIA has collaborated with Google to optimize large language models, partnered with Amazon to launch the NVIDIA DGX cloud platform hosting services on the AWS platform, and leveraged AI platforms for drug development, precision medicine, and medical imaging. Collaborations with Singapore Telecom, Cisco, and support for the U.S. National Artificial Intelligence Research Resource Pilot Program were also highlighted.

In the gaming business sector, NVIDIA reported a fourth-quarter revenue of $2.9 billion, remaining consistent with the previous quarter and witnessing a 56% year-over-year growth. The annual revenue increased by 15%, reaching $10.4 billion. NVIDIA announced the successful deployment of its RTX platform in less than six years, with over 100 million PCs now equipped with RTX graphics cards. These AI PCs benefit from generative AI features, including Tensor-RT LLM for accelerating large language model inference and the local personalized chatbot "Chat with RTX."

In the professional visualization sector, NVIDIA reported a fourth-quarter revenue of $463 million, showing an 11% sequential increase and an impressive 105% year-over-year growth. The annual revenue increased by 1% to $1.6 billion.

In the automotive business sector, NVIDIA reported a fourth-quarter revenue of $281 million, experiencing an 8% sequential increase but a 4% year-over-year decline. The annual revenue increased by 21%, reaching $1.1 billion.

Looking ahead, NVIDIA forecasts a first-quarter revenue of $24 billion for the 2025 fiscal year, with a margin of ±2%. The GAAP and non-GAAP gross margins are expected to be 76.3% and 77.0%, respectively, with a margin of ±0.5%.