Microchip Technology, a leading microcontroller (MCU) manufacturer, released its third-quarter financial results for the fiscal year 2025, ending December 31, 2024, after the U.S. market closed on Thursday, February 6. The company reported a significant decline in revenue that exceeded market expectations, with guidance for the upcoming quarter also falling short of analyst forecasts. As a result, Microchip's stock dropped by 6.85% in after-hours trading.

For the third quarter, Microchip's revenue plunged 41.9% year-over-year and declined 11.8% compared to the previous quarter, reaching $1.026 billion. This figure slightly exceeded the midpoint of the forecasted range of $1.025 billion, but still fell below the $1.05 billion analysts had expected. Non-GAAP earnings per share (EPS) dropped 81.5% year-over-year to $0.20, missing the company's forecast of $0.25 and analysts' estimate of $0.28. Non-GAAP gross margin also decreased, dropping from 63.8% in the same quarter last year to 55.4%.

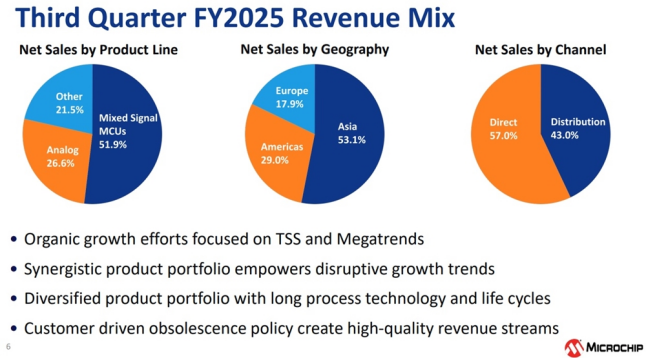

Regionally, 53.1% of Microchip's third-quarter revenue came from Asia, 29.0% from the Americas, and 17.9% from Europe.

Microchip has faced an excess supply of capacity since the first quarter of calendar year 2024, primarily due to lower demand for mature-process chips used in automotive and consumer products. This led to a continuous decline in performance and an elevated inventory level. During a November earnings call, former CEO Ganesh Moorthy indicated that customers, particularly in the industrial and automotive sectors, have been managing inventory strictly and adjusting procurement plans in response to macroeconomic factors such as high interest rates and ongoing supply chain challenges.

To address these issues, Microchip has announced plans to cut back on production capacity by shutting down its Tempe, Arizona wafer fab by September 2025. This decision follows high inventory levels and excess available capacity at its Oregon and Colorado fabs. The closure is expected to impact approximately 500 employees and save the company around $90 million. Additionally, Microchip intends to forgo a $162 million subsidy agreement with the U.S. Department of Commerce to avoid exacerbating its capacity surplus.

Looking ahead, Microchip has projected that fourth-quarter revenue will range between $920 million and $1.00 billion, with the midpoint at $960 million, below analysts' expectations of $1.05 billion. Non-GAAP EPS is expected to range from $0.05 to $0.15, significantly lower than the expected $0.27. Gross margin is forecast to be between 52.0% and 54.0%.

It is also worth noting that other major MCU manufacturers in the automotive and industrial sectors, such as STMicroelectronics and NXP Semiconductors, have reported declines in their performance for the first quarter and fourth quarter of calendar year 2024 due to weak demand and high inventory levels.

According to STMicroelectronics' financial report, the company's revenue for fiscal year 2024 fell by 23.2% to $13.27 billion, and operating profit dropped by 12.6%. In Q4 of 2024, revenue rose 22.4% year-over-year to $3.32 billion, but operating profit decreased by 63.0% to $341 million. In response, STMicroelectronics plans to close all its wafer fabs for the first time this fiscal year, affecting approximately 3,000 employees.

NXP's financial report revealed a 5% year-over-year decline in full-year revenue to $12.61 billion and a 6.6% drop in non-GAAP EPS to $13.09. For Q4 of 2024, NXP's revenue fell 9% year-over-year and 4% sequentially to $3.11 billion. Non-GAAP EPS dropped 14.3% year-over-year and 7.8% sequentially to $3.18. Due to these results and potential tariff issues, NXP plans to reduce its global workforce by up to 5%, affecting 1,700 to 1,800 employees.