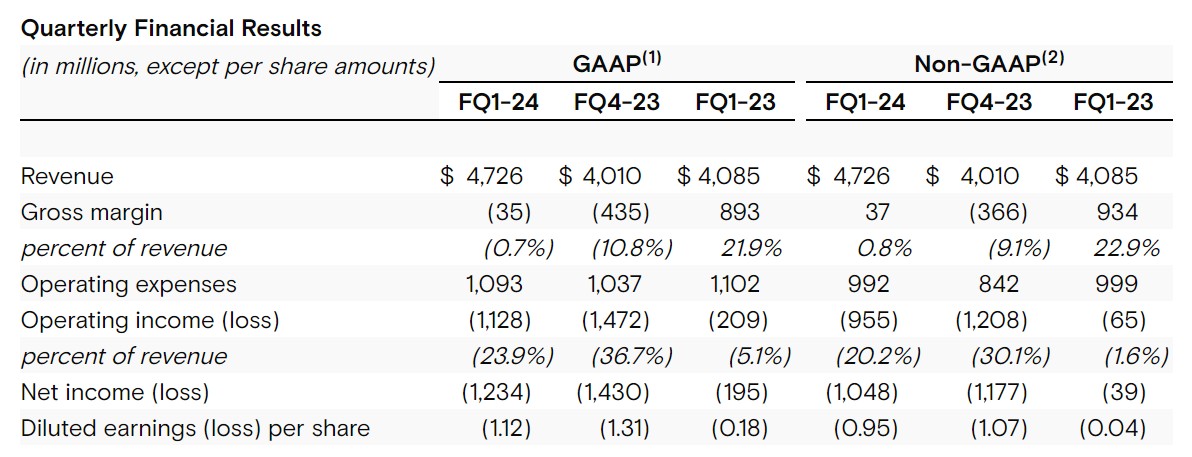

Micron Corporation has disclosed its financial performance for the first quarter of the fiscal year 2024 (September 1, 2023, to November 30, 2023), reporting a revenue of $4.726 billion. This represents a notable year-over-year increase of 15.6% and a sequential growth of 17.9%. In accordance with Generally Accepted Accounting Principles (GAAP), Micron recorded a net loss of $1.23 billion, resulting in a diluted loss per share of $1.12. On a non-GAAP basis, the net loss was $1.05 billion, with a diluted loss per share of $0.95. The company's operating cash flow for the quarter amounted to $1.4 billion, a significant rise from the previous quarter's $249 million.

Micron's President and CEO, Sanjay Mehrotra, attributes the favorable first-quarter performance to the company's robust execution and pricing capabilities. Mehrotra expresses confidence in the enhancement of business fundamentals throughout the 2024 fiscal year, anticipating a record high in the industry Total Addressable Market (TAM) in 2025. He underscores Micron's technological prowess through the introduction of its leading High Bandwidth Memory (HBM) tailored for data center artificial intelligence applications, positioning the company to capitalize on extensive opportunities presented by artificial intelligence across diverse markets.

In the first quarter, Micron's capital expenditures totaled $1.73 billion, resulting in an adjusted free cash flow of -$333 million. As of the quarter's conclusion, Micron maintained a financial position with cash, investments in securities, and restricted cash amounting to $9.84 billion. Notably, on December 20, Micron declared a quarterly dividend of $0.115 per share.

Looking ahead, Micron forecasts revenue for the second quarter of the 2024 fiscal year (December 1, 2023, to February 29, 2024) within the range of $5.1 billion to $5.5 billion, exceeding analysts' expectations of $4.99 billion. The company anticipates a further reduction in the diluted net loss per share, ranging between $0.21 and $0.35. Projected second-quarter gross margin is set at 12.0%, with operating expenses totaling $1.07 billion.

Micron's positive outlook suggests a successful rebound for the company, underscoring its return to profitability after a challenging period. The flourishing development of artificial intelligence emerges as a key driver for heightened demand for storage chips in data centers.

Mehrotra reveals that Micron's production capacity for HBM chips in 2024 is fully committed, marking the commencement of substantial opportunities for this high-revenue, high-profit product. Micron foresees a growth rate in personal computer sales in 2024, likely below 5% after two consecutive years of decline, along with indications of a modest recovery in smartphone demand.

Regarding Micron's storage chip production capacity, Mehrotra discloses plans to increase capacity following a rebound in product prices. A recent report from research firm TrendForce underscores a quarter-over-quarter increase of approximately 18-23% in mobile DRAM in the fourth quarter of 2023, with eMMC and UFS flash memory experiencing increases of about 10-15%. TrendForce predicts a continued upward trajectory in prices for these storage chips throughout 2024.